Investing in emerging markets has become an increasingly attractive option as investors seek to diversify their portfolios and maximize returns.

With the potential for high growth and returns and a diverse range of investment opportunities, understanding the risks and opportunities associated with emerging markets is essential.

This blog explores the opportunities and risks of investing in emerging markets, providing readers with valuable insights into navigating this exciting and dynamic investment landscape.

What are emerging markets?

Emerging markets are economies of countries that are in the process of becoming more developed and experiencing rapid growth and industrialization.

These markets are typically characterized by higher levels of economic growth and a lower level of per capita income when compared to developed markets.

On the other hand, developed markets are characterized by stable economic growth and typically have higher levels of per capita income, a more developed infrastructure, and greater access to technology and other resources.

One key difference between emerging and developed markets is the level of risk associated with investing.

Emerging markets are often considered riskier due to factors such as political instability, currency fluctuations, and less developed legal and regulatory frameworks.

However, they also offer the potential for higher returns due to their faster economic growth and greater potential for development.

What are the potential advantages of investing in emerging markets?

Investing in emerging markets can offer several potential advantages to investors, including:

High Growth Potential

Emerging markets have the potential for high economic growth rates due to factors such as a growing middle class, rising consumer spending, and increased investment in infrastructure and technology.

Diversification

Investing in emerging markets can help diversify an investor’s portfolio, reducing overall risk and increasing potential returns.

Access to a Wide Range of Investment Opportunities

Emerging markets offer diverse investment opportunities across various sectors, including healthcare, energy, finance, and technology.

Undervalued Assets

Many emerging market assets are undervalued relative to developed markets, presenting an opportunity for investors to enter at a lower price point and potentially benefit from future price appreciation.

Increasing Globalization

Emerging markets are becoming increasingly integrated into the global economy, providing investors with exposure to new markets and opportunities.

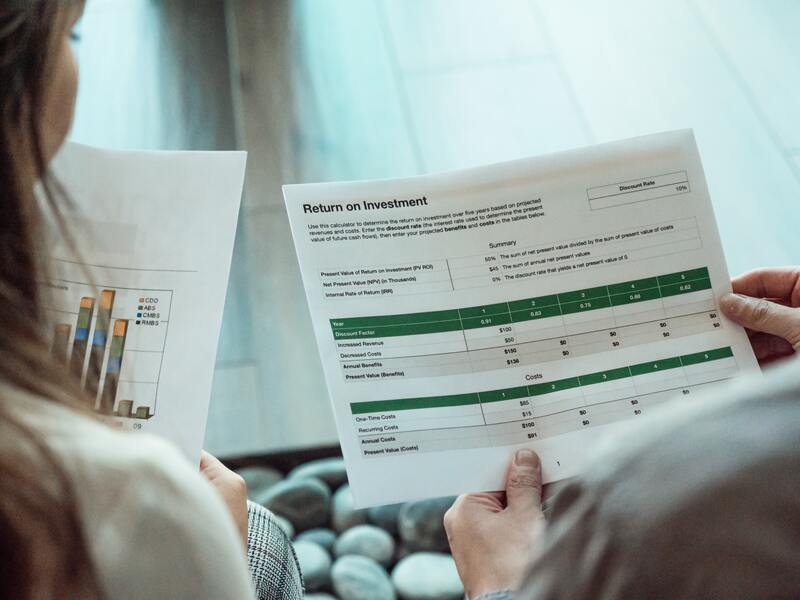

Investing in emerging markets has the potential for high economic growth rates. Photo by Kindel Media

What are the risks associated with investing in emerging markets?

Investing in emerging markets also comes with several risks that investors should be aware of, including:

Political Risk

Emerging markets can be politically unstable, with the potential for changes in government policies, social unrest, or conflicts that can negatively impact investments.

Economic Risk

Economic risks such as inflation, currency fluctuations, and changes in interest rates can significantly impact investments in emerging markets.

Market Risk

Emerging markets can be more volatile than developed markets, with greater fluctuations in stock prices and less liquidity.

Legal and Regulatory Risk

Emerging markets often have less developed legal and regulatory frameworks, which can lead to greater uncertainty and risk for investors.

Operational Risk

Operating in emerging markets can also present operational risks, including difficulties navigating local laws and regulations, finding reliable partners, and accessing necessary infrastructure and resources.

What are some of the most attractive emerging market investment opportunities?

Emerging markets offer a diverse range of investment opportunities across various sectors, each with its own unique potential for growth and returns.

One of the most attractive emerging market investment opportunities is in the technology sector.

As emerging markets continue to modernize and digitalize, there is a growing demand for technology products and services, presenting an opportunity for investors to tap into the high-growth potential of this sector.

Another attractive investment opportunity is in the consumer goods sector.

As middle-class populations continue to grow in emerging markets, there is an increasing demand for consumer goods such as automobiles, electronics, and household appliances.

Investing in these industries can provide exposure to a growing consumer base and potentially high returns.

Another promising investment opportunity in emerging markets is in the healthcare sector.

As healthcare infrastructure and services continue to develop in these markets, there is a growing demand for medical devices, pharmaceuticals, and healthcare services.

This presents an opportunity for investors to tap into a sector with significant growth potential, particularly in areas such as chronic disease management and healthcare technology.

Finally, the renewable energy sector is another attractive investment opportunity in emerging markets. As countries in these markets look to reduce their dependence on fossil fuels and address environmental concerns, there is a growing demand for renewable energy sources such as solar and wind power.

Investing in these industries can provide exposure to a sector with significant potential for growth and long-term returns.

How can investors mitigate the risks associated with investing in emerging markets?

Investing in emerging markets comes with inherent risks that investors should be aware of. However, there are several strategies that investors can use to mitigate these risks, including:

Diversification

Diversifying investments across different countries, sectors, and asset classes can help reduce overall risk and potentially increase returns.

Research

Conducting thorough research on each market’s political, economic, and regulatory environment can help investors make informed investment decisions and avoid potential risks.

Long-term Perspective

Investing in emerging markets with a long-term perspective can help investors ride out short-term volatility and potentially benefit from higher returns over time.

Professional Advice

Seeking the advice of professionals such as financial advisors, investment managers, and lawyers can help investors navigate the unique risks associated with investing in emerging markets.

Currency Hedging

Using currency hedging strategies can help mitigate the impact of currency fluctuations on investments in emerging markets.

Monitoring

Regularly monitoring investments and staying up-to-date on market developments can help investors identify and respond to potential risks in a timely manner.

Using currency hedging strategies can help mitigate the impact of currency fluctuations when investing in emerging markets. Photo by Karolina Grabowska

What are the key economic, political, and social factors that affect emerging markets?

Emerging markets are subject to a wide range of economic, political, and social factors that can significantly impact investment opportunities and risk.

One of the key economic factors that affect emerging markets is their level of infrastructure development.

The availability of reliable transportation, communication, and energy infrastructure is critical for economic growth and development, and investing in emerging markets with strong infrastructure can present attractive opportunities for investors.

Political factors also play a significant role in the performance of emerging markets.

Changes in government policies, political instability, corruption, and social unrest can all negatively impact investment opportunities and increase overall risk.

Investors must carefully evaluate the political environment in each market and assess the potential impact of any political developments on their investments.

Finally, social factors such as demographics, education, and cultural norms can also have a significant impact on emerging markets.

For example, investing in emerging markets with a large and growing middle class can present attractive opportunities for investors in consumer goods and services.

Similarly, investing in markets with a well-educated workforce and a culture of innovation can present opportunities in technology and healthcare.

What are the best ways for individual investors to access emerging markets?

There are several ways for individual investors to access emerging markets, including:

Exchange-Traded Funds (ETFs)

ETFs offer a simple and cost-effective way to gain exposure to emerging markets, allowing investors to purchase shares of a diversified portfolio of emerging market securities.

Mutual Funds

Mutual funds offer a similar option to ETFs, allowing investors to purchase a diversified portfolio of emerging market securities managed by a professional fund manager.

Direct Equity Investment

Investors can also choose to invest directly in emerging market stocks, either through individual stock purchases or by investing in emerging market-focused mutual funds or ETFs that invest in individual stocks.

Bonds

Investing in emerging market bonds can provide exposure to the fixed-income market in emerging markets, with potential opportunities for high returns and diversification.

Real Estate Investment

Investing in the emerging market real estate can provide exposure to a rapidly growing and developing market, with potential opportunities for rental income and long-term appreciation.

It is important for individual investors to carefully consider their investment goals, risk tolerance, and time horizon when selecting an investment strategy for accessing emerging markets.

Seeking the advice of professionals and conducting thorough research on individual markets and investment opportunities can also help investors make informed investment decisions.

What are the potential long-term trends in emerging markets that investors should be aware of?

Emerging markets are subject to a range of economic, political, and social factors that can impact their long-term growth and development.

However, investors should be aware of several potential long-term trends in emerging markets when considering investment opportunities.

One key trend is the ongoing urbanization of emerging markets.

As more people move from rural areas to cities, there is an increasing demand for urban infrastructure, housing, and services, presenting potential investment opportunities in sectors such as real estate, transportation, and healthcare.

Another trend is the growing middle class in many emerging markets. As incomes rise, the demand for consumer goods and services, including automobiles, electronics, and leisure activities, grows.

Investing in companies that cater to this growing middle class can present attractive opportunities for investors.

A third trend is the continued development of technology and innovation in emerging markets.

As these markets become more integrated into the global economy, there is a growing focus on technology and innovation, with potential investment opportunities in sectors such as fintech, healthcare technology, and e-commerce.

Finally, environmental and social sustainability is becoming an increasingly important consideration in emerging markets, with a growing focus on renewable energy, sustainable agriculture, and social responsibility.

Investing in companies that prioritize sustainability and social responsibility can provide attractive returns and align with investors’ values and priorities.

How do emerging market investments fit into a diversified investment portfolio?

Emerging market investments can play an important role in a diversified investment portfolio by providing exposure to higher-growth markets and diversifying risk across different asset classes and geographic regions.

A diversified investment portfolio typically includes a mix of assets such as stocks, bonds, and alternative investments and exposure to different geographic regions and market sectors.

Emerging market investments can provide exposure to markets with the potential for high growth rates and returns, diversifying the portfolio’s overall risk.

However, it is important to note that emerging market investments can be more volatile and subject to greater risk than investments in more developed markets.

Therefore, investors should carefully consider their risk tolerance and investment objectives before allocating a portion of their portfolio to emerging market investments.

In addition, investors should also consider the potential benefits of investing in emerging markets through a diversified fund such as an ETF or mutual fund.

These investment vehicles can provide exposure to a diversified portfolio of emerging market securities managed by a professional fund manager, reducing individual company risk and potentially increasing returns.

What are the tax implications of investing in emerging markets?

Investing in emerging markets can have tax implications for investors, including potential taxes on capital gains, dividends, and interest income.

The tax treatment of investments in emerging markets can vary depending on the specific country and the investor’s country of residence.

In some cases, investors may be subject to withholding taxes on dividends and interest income earned in emerging markets.

Withholding taxes are taxes automatically deducted from an investor’s earnings and paid directly to the country’s government where the investment is made.

In addition, investors may be subject to capital gains taxes on the sale of investments in emerging markets.

Capital gains taxes are taxes on the profits earned from the sale of an investment, and the tax rate can vary depending on the holding period and the country where the investment was made.

It is important for investors to understand the tax implications of investing in emerging markets and to consult with tax professionals to ensure compliance with local tax laws and regulations.

In some cases, investors may be able to take advantage of tax treaties or other agreements between their country of residence and the country where the investment was made to minimize their tax liability.

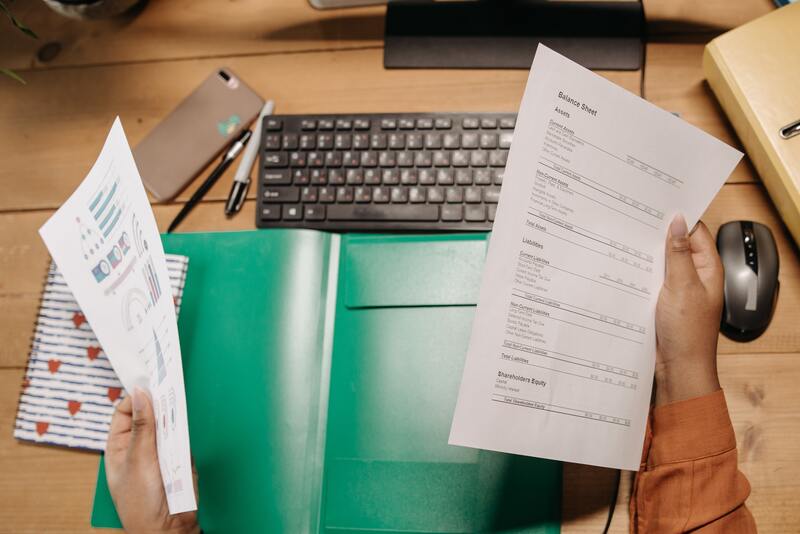

When investing in emerging markets, examining a company’s financial statements can provide insights into its financial health and stability. Photo by Pavel Danilyuk

How can investors evaluate the financial health and stability of individual companies in emerging markets?

Evaluating individual companies’ financial health and stability in emerging markets can be challenging due to differences in accounting standards and regulatory environments.

However, there are several strategies that investors can use to assess the financial health and stability of individual companies in emerging markets.

- Financial Statements: Examining a company’s financial statements, including balance sheets, income statements, and cash flow statements, can provide insights into its financial health and stability. Investors should look for signs of profitability, cash flow generation, and overall financial stability.

- Market Analysis: Analyzing a company’s market position and competitive advantages can provide insights into its long-term growth prospects and overall financial health. Investors should consider factors such as market share, brand strength, and barriers to entry when evaluating companies in emerging markets.

- Management Quality: Evaluating the quality of a company’s management team can provide insights into its overall financial health and stability. Investors should consider factors such as management experience, track record, and alignment of interests with shareholders.

- Regulatory Environment: Understanding the regulatory environment in which a company operates can provide insights into its financial health and stability. Investors should consider factors such as regulatory compliance, legal risks, and potential for government intervention when evaluating companies in emerging markets.

- Professional Analysis: Seeking the advice of professionals such as financial analysts, investment managers, and legal experts can provide valuable insights into the financial health and stability of individual companies in emerging markets.

No responses yet